加拿大统计局公布了2022年的收入调查报...

Read MoreCategories

Recent Posts

- AiF观点 | 7大权重股对市场的影响 April 26, 2024

- AiF观点 | 加拿大统计局:中产年入7万, 你达标了吗? April 26, 2024

- S&P 500 posts best week since November, Nasdaq surges 2% Friday as Alphabet soars April 26, 2024

- AiF观点 | 核心通胀又涨了!意味着大家的支出又涨了! April 26, 2024

- S&P 500 and Nasdaq jump, boosted by Alphabet and Microsoft April 26, 2024

- 道指因美国经济增长放缓而下跌500点 | Ai Financial 财经日报 April 25, 2024

- AiF观点 | 加拿大打击房地产泡沫初见成效 April 24, 2024

- AiF观点 | 美联储:长期高利率不是坏事 April 24, 2024

- 特斯拉股价飙升12%,股市在盈利热潮中步履维艰 | Ai Financial 财经日报 April 24, 2024

- 五年翻倍的基金选择策略 | Ai Financial基金投资 April 24, 2024

Mar 27 | Daily Finance News

Post Views: 620

U.S. STOCK PICKS

Closing: 4:00 PM EST

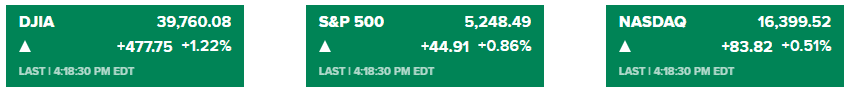

- The S&P 500 rose Wednesday, closing at a record and snapping a three-day string of losing sessions.

- The broader market index gained 0.86%, while the Dow Jones Industrial Average advanced 477.75 points, or 1.22%. It was the first winning day in four for both indexes. The Nasdaq Composite rose 0.51%.

- As of Wednesday’s close, the S&P 500 has added nearly 3% in the month and 10% in the quarter. The Nasdaq has climbed 1.9% in March and about 9.3% during the three-month period, while the Dow has added 1.9% and roughly 5.5% during the respective periods.

- This would mark the best first-quarter gain for the S&P 500 and 30-stock Dow since 2019 and 2021, respectively, when the indexes rose 13.1% and 7.4%. All three major averages are on pace to notch their fifth straight winning month and second consecutive positive quarter.

- A majority of investors believe a stock market pullback is near, according to CNBC survey.

- Amazon spends $2.75 billion on AI startup Anthropic in its largest venture investment yet.

CANADA MARKET

- Canadians cutting back on restaurant spending, turning to takeout, amid high cost of living.

*All information sourced from news portals such as CNBC, Yahoo Finance, Reuters, etc.

Mar 27 | Daily Finance News

U.S. STOCK PICKS

- Stocks rise as S&P 500 tries to snap 3-day losing streak.

- The two best-performing stocks in the S&P 500 include Cintas, up 8% on the back of better-than-expected earnings.

- Shares of Merck were up nearly 5% — hitting a new all-time high — after the Food and Drug Administration passed approval for Winrevair, the company’s life-threatening lung condition treatment, for use among patients with pulmonary arterial hypertension.

- Later in the week, investors will watch for data on jobless claims, gross domestic product and consumer sentiment on Thursday. While the market is closed on Good Friday, attention will be on releases tied to personal income, consumer spending and the personal consumption expenditures expected in the morning.

- U.S. stocks have ‘limited upside’ from here, says Goldman Sachs Asset Management.

- Applications to refinance a home loan fell 2% for the week and were 9% lower than the same week one year ago. Applications for a mortgage to purchase a home decreased 0.2% from the week before and were 16% lower year over year.

CANADA MARKET

- The Canadian government’s recently announced plans to soft-cap temporary resident numbers should pave the way for interest rate cuts to happen sooner and more frequently, but could have “adverse consequences” for the overall economy, according to Desjardins.

- Oil falls for second day as US crude inventories surge.

- Business leaders say housing biggest risk to economy: KPMG survey

RELATED READING

S&P 500 posts best week since November, Nasdaq surges 2% Friday as Alphabet soars

周五,股市上涨,标普500指数和纳斯达克...

Read MoreS&P 500 and Nasdaq jump, boosted by Alphabet and Microsoft

Stocks jumped Friday as Big Tech names Alphabet and Microsoft rallied on strong ……

Read MoreS&P 500 posts best week since November, Nasdaq surges 2% Friday as Alphabet soars

周五,股市上涨,标普500指数和纳斯达克...

Read MoreS&P 500 and Nasdaq jump, boosted by Alphabet and Microsoft

Stocks jumped Friday as Big Tech names Alphabet and Microsoft rallied on strong ……

Read MoreSubscribe to Ai Financial Newsletter

Sign up for our weekly stock market update and be the first to know about our webinars.