道琼斯工业平均指数首次跃升至40,000...

Read MoreCategories

Recent Posts

- 道琼斯周四收盘下跌,首次短暂突破40,000点 | Ai Financial 财经日报 May 16, 2024

- AiF观点 | 号外!号外!道琼斯指数首次突破4万点大关! May 16, 2024

- 道琼斯指数正朝着4万点的里程碑迈进 | Ai Financial 财经日报 May 16, 2024

- S&P 500跃升1%,创下历史新高收盘,首次收盘超过5300点 | Ai Financial 财经日报 May 15, 2024

- 解读华尔街谚语-Sell in May and Go Away? | Ai Financial 基金投资 May 15, 2024

- AiF观点 | 三大股指再创新高!你在市场里么? May 15, 2024

- 标普500和纳斯达克在消费者通胀报告发布后上涨至历史新高 | Ai Financial 财经日报 May 15, 2024

- AiF观点 | 市场:美联储不降息?那我们涨吧! May 14, 2024

- 消费者通胀报告公布前夕,纳斯达克指数创下历史新高收盘 | Ai Financial 财经日报 May 14, 2024

- AiF观点 | 今天凌晨,美国动手啦! May 14, 2024

- AiF观点 | 美联储还没打算降息,加拿大已经挺不住了 May 14, 2024

- 最新的美国通胀数据发布后,股市小幅上涨 | Ai Financial 财经日报 May 14, 2024

- 道指连续八个交易日上涨后首次下跌,因消费者对通胀预期上升 | Ai Financial 财经日报 May 13, 2024

- AiF观点 | 又一家价格超过价值的公司下市了 May 13, 2024

- 【Weekly recap】 Rising earnings keep the bull market intact; Inflation data remains in focus May 13, 2024

- AiF insight | GameStop, Game start? again? May 13, 2024

- Wall Street hovers on the brink of reaching new highs. May 13, 2024

- The Dow Jones continues its eighth straight day of gains, with the S&P 500 edging back towards record highs. May 10, 2024

- AiF insight | Will Canada Cut Interest Rates in June? May 10, 2024

- AiF insight | What Is a Dead Cat Bounce in the Stock Market? May 10, 2024

U.S. STOCK PICKS

Closing: 4:00 PM EST

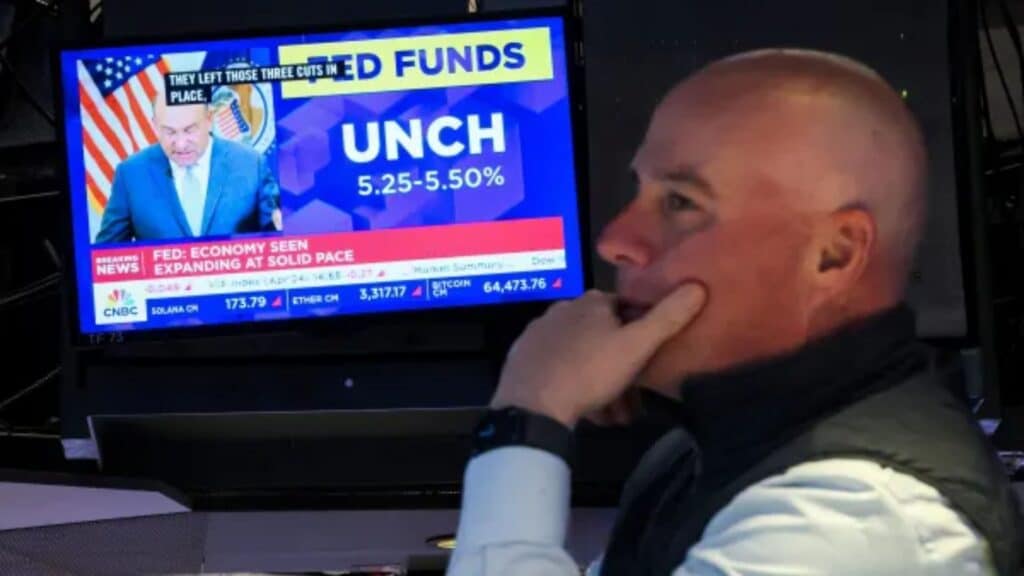

- The Dow Jones Industrial Average closed higher on Wednesday after Federal Reserve Chair Jerome Powell largely ruled out that the central bank’s next move could be a hike, easing investor worries that it was losing control of sticky inflation. The broader market finished lower, however, with losses from chipmakers dragging down the S&P 500.

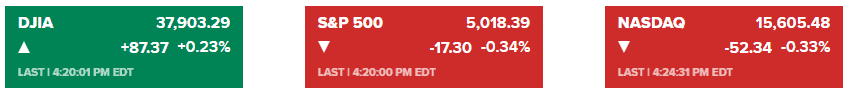

- The Dow added 87.37 points, or 0.23%, to close at 37,903.29. The S&P 500 lost 0.34% to close at 5,018.39, while the Nasdaq Composite slid 0.33% to settle at 15,605.48.

- It was a volatile day for the major averages, with the 30-stock Dow rallying more than 530 points at its session high, spurred by Powell’s comments. At one point, the S&P 500 was up 1.2%, while the Nasdaq climbed more than 1.7%.

- The central bank opted to hold rates steady, citing a “lack of further progress” in bringing inflation back down toward its 2% goal. However, Powell ruled out the likelihood of a hike in a press conference following the decision.

- Corporate earnings were in focus for investors, as well. Disappointing results from chipmaker AMD (AMD) and server maker Super Micro Computer (SMCI) took the shine off hopes for an AI-fueled boost to the sector.

- AMD shares sank nearly 10% while Super Micro fell 14%. The news weighed more broadly on chipmakers like Nvidia (NVDA), which closed down about 4%.

- Long-predicted consumer pullback finally hits restaurants like Starbucks, KFC and McDonald’s that reported same-store sales declines this quarter.

- Qualcomm gives better-than-expected revenue forecast as company pushes AI-powered smartphones.

U.S. STOCK PICKS

- On Wednesday, the S&P 500 index fell as investors focused on the Federal Reserve's interest rate policy decision.

- Traders are now turning their attention to the Fed's interest rate decision on Wednesday afternoon. The market expects the Federal Open Market Committee, the central bank's policy-setting arm, to announce little to no change in interest rates. Wall Street will be looking for clues from Fed Chair Powell on when interest rates might be lowered.

- Investors received another clue about the labor market ahead of Friday's April employment report. ADP data showed that private sector employment increased by 192,000 in April, indicating a resilient labor market that exceeded expectations.

- U.S. manufacturing contracted in April, with orders declining after briefly expanding in the prior month, while the prices paid by factories for inputs approached a two-year high.

- Amazon's stock rose by about 3% as its first-quarter earnings and revenue exceeded expectations.

- Chipmaker Intel's stock fell by 7% after issuing revenue forecasts in line with expectations for the current quarter.

- Super Micro Computer's stock fell by 12% as its revenue came in slightly below the Street's consensus estimates.

- Starbucks' stock fell by 15% after slashing its outlook following disappointing same-store sales.

- CVS Health's stock fell by 18% after posting disappointing earnings and cutting profit guidance, marking its worst day since November 2009.

- NYCB's stock rose after its new CEO outlined a two-year plan for a "clear path to profitability."

- Pfizer exceeded revenue expectations, raising profit outlook on cost cuts and a smaller-than-feared drop in Covid drug sales.

- UnitedHealth was hit by a cyberattack, forcing doctors to dip into personal savings to make ends meet.

- Amazon cloud revenue and AI push offset weak Q2 retail outlook.

- Microsoft signed a deal to invest more than $10 billion on renewable energy capacity to power data centers.

- According to the Mortgage Bankers Association, the share of adjustable-rate mortgage applications rose to 7.8% of mortgage demand last week, reaching the highest level of the year.

*All information sourced from news portals such as CNBC, Yahoo Finance, Reuters, etc.

RELATED READING

Subscribe to Ai Financial Newsletter

Sign up for our weekly stock market update and be the first to know about our webinars.