道琼斯工业平均指数首次跃升至40,000...

Read MoreCategories

Recent Posts

- 道琼斯周四收盘下跌,首次短暂突破40,000点 | Ai Financial 财经日报 May 16, 2024

- AiF观点 | 号外!号外!道琼斯指数首次突破4万点大关! May 16, 2024

- 道琼斯指数正朝着4万点的里程碑迈进 | Ai Financial 财经日报 May 16, 2024

- S&P 500跃升1%,创下历史新高收盘,首次收盘超过5300点 | Ai Financial 财经日报 May 15, 2024

- 解读华尔街谚语-Sell in May and Go Away? | Ai Financial 基金投资 May 15, 2024

- AiF观点 | 三大股指再创新高!你在市场里么? May 15, 2024

- 标普500和纳斯达克在消费者通胀报告发布后上涨至历史新高 | Ai Financial 财经日报 May 15, 2024

- AiF观点 | 市场:美联储不降息?那我们涨吧! May 14, 2024

- 消费者通胀报告公布前夕,纳斯达克指数创下历史新高收盘 | Ai Financial 财经日报 May 14, 2024

- AiF观点 | 今天凌晨,美国动手啦! May 14, 2024

- AiF观点 | 美联储还没打算降息,加拿大已经挺不住了 May 14, 2024

- 最新的美国通胀数据发布后,股市小幅上涨 | Ai Financial 财经日报 May 14, 2024

- 道指连续八个交易日上涨后首次下跌,因消费者对通胀预期上升 | Ai Financial 财经日报 May 13, 2024

- AiF观点 | 又一家价格超过价值的公司下市了 May 13, 2024

- 【Weekly recap】 Rising earnings keep the bull market intact; Inflation data remains in focus May 13, 2024

- AiF insight | GameStop, Game start? again? May 13, 2024

- Wall Street hovers on the brink of reaching new highs. May 13, 2024

- The Dow Jones continues its eighth straight day of gains, with the S&P 500 edging back towards record highs. May 10, 2024

- AiF insight | Will Canada Cut Interest Rates in June? May 10, 2024

- AiF insight | What Is a Dead Cat Bounce in the Stock Market? May 10, 2024

U.S. STOCK PICKS

Closing: 4:00 PM EST

- 周四,股市上涨,投资者期待更多的企业财报和本周晚些时候发布的关键劳动力报告。

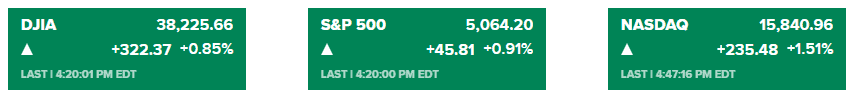

- 道琼斯工业平均指数上涨了322.37点,或0.85%,收于38225.66点。标普500指数上涨了0.91%,收于5064.20点,纳斯达克综合指数上涨了1.51%,收于15840.96点。

- 芯片制造商高通因盈利超过预期和强劲的营收指引而上涨了9.8%。

- DoorDash报告每股亏损更大后下跌了10.3%。

- 二手车零售商Carvana因周三收盘后发布有史以来最佳财报而飙升了33.8%。

- Moderna因亏损小于预期而大涨了12.7%。

- 在国债收益率下跌的情况下,大型科技股上涨,英伟达和亚马逊股价分别上涨了超过3%。苹果在收盘前上涨了2.3%,即将公布季度财报。

- 投资者现在将注意力转向周五的4月非农就业报告,道琼斯对经济学家的调查显示,他们预计新增就业岗位为24万个,较3月的30.3万个新增有所放缓。

- 苹果的财政第二季度收益略高于华尔街的预期,但整体营收下降了4%,iPhone销量下降了10%。苹果宣布其董事会授权进行1100亿美元的股票回购,这是公司历史上最大的回购计划。苹果首席执行官蒂姆·库克告诉CNBC,与去年同期相比,年度销售收入受到了困难的比较的影响。

- 索尼和阿波罗致信表示有兴趣以 260 亿美元收购派拉蒙,公司正在考虑竞购 Skydance。

U.S. STOCK PICKS

- Stocks rose Thursday as investors looked ahead to more corporate earnings and a key labor report set for later in the week.

- Chipmaker Qualcomm rose more than 5% on better-than-expected adjusted earnings and strong revenue guidance.

- Restaurant delivery service DoorDash dropped 11% after reporting a wider loss per share than Wall Street forecast.

- Used-car retailer Carvana soared 38% after reporting best-ever earnings after the bell Wednesday.

- MGM Resorts International roared 5.9% higher after likewise topping forecasts for profit and revenue. It credited stronger traffic at MGM China, which ramped up as COVID-19 restrictions fell away in Macau.

- Peloton Interactive jumped 8.4% after it said it would cut roughly 400 jobs as part of a program to save $200 million in costs annually. It also said its CEO, Barry McCarthy, is stepping down. The company’s stock had fallen to a record low last week.

- Those moves helped to offset a 17.9% drop for Etsy, which only roughly matched analysts’ expectations for results and revenue.

- Wayfair shares surge 17% after furniture retailer cuts losses by more than $100 million.

- Google lays off hundreds of ‘Core’ employees, moves some positions to India and Mexico.

- One showed that fewer U.S. workers applied for unemployment benefits last week than economists expected. It’s the latest signal that the job market remains solid despite high interest rates.

- A separate, potentially more disappointing report for Wall Street suggested growth in how much U.S. workers produced per hour worked was weaker at the start of 2024 than economists expected. A measure comparing labor costs to productivity, meanwhile, rose by more than expected in the preliminary report. That could put upward pressure on inflation, which is one of the biggest fears on Wall Street.

- Traders still expect a rate cut won’t come until at least September, according to the latest futures market pricing as measured the CME Group.

*All information sourced from news portals such as CNBC, Yahoo Finance, Reuters, etc.

RELATED READING

Subscribe to Ai Financial Newsletter

Sign up for our weekly stock market update and be the first to know about our webinars.