五年翻倍的投资回报是...

Read More近期文章

- AiF观点 | 加拿大打击房地产泡沫初见成效 4月 24, 2024

- AiF观点 | 美联储:长期高利率不是坏事 4月 24, 2024

- 特斯拉股价飙升12%,股市在盈利热潮中步履维艰 | Ai Financial 财经日报 4月 24, 2024

- 五年翻倍的基金选择策略 | Ai Financial基金投资 4月 24, 2024

Maximize your TFSA contribution, you would save $12,071.11 CAD in tax

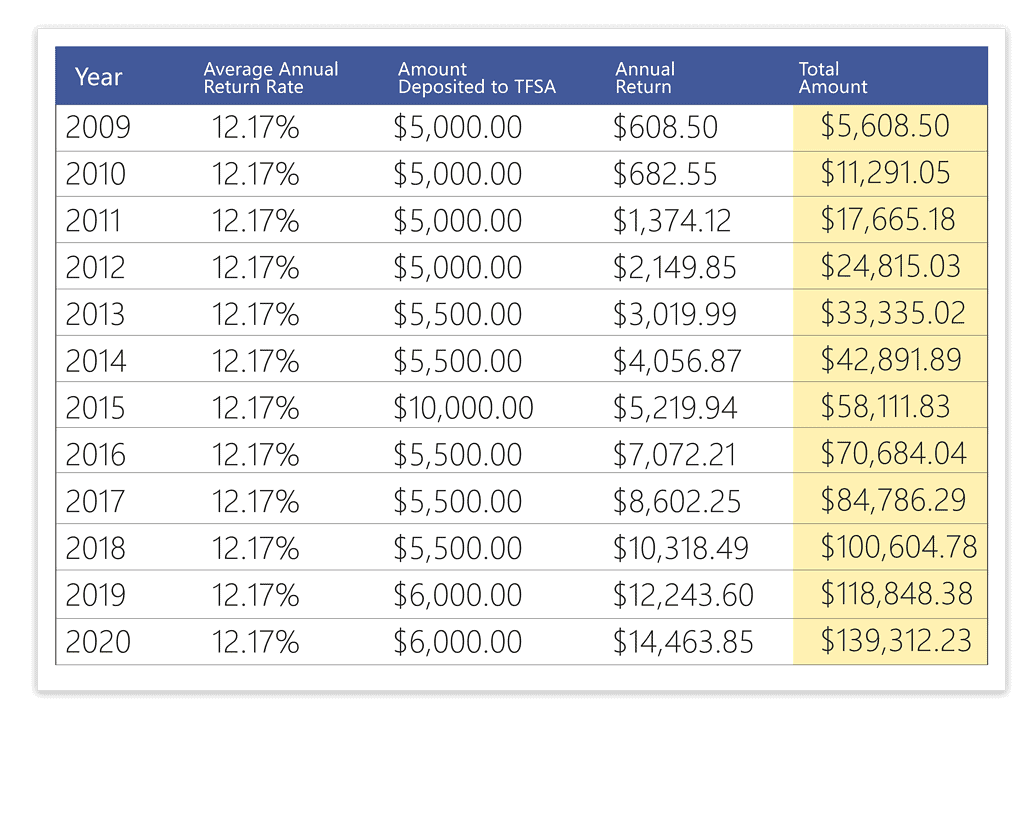

If you had maximized your TFSA contribution since its inception, you would have saved $12,071.11 CAD in tax up until end of year 2020. Below is the detailed calculation, you can easily see the difference in tax savings using TFSA vs using Non-registered Accounts.

The Tax-Free Savings Account (TFSA) program began in 2009. It is a way for individuals who are 18 and older and who have a valid social insurance number to set money aside tax-free throughout their lifetime. Contributions to a TFSA are not deductible for income tax purposes.

The types of investments that are permitted in a TFSA include cash, mutual funds, stocks, ETFs, bonds and GICs.

Below we use the SPDR S&P 500 ETF TRUST (SPY) as the investment product for our calculation. The SPY reflects the overall U.S. economy, and the upward trend of the U.S. economy has taken shape.. From year 2009 to year 2020, (the 2020 return rate is calculated as of November 13), for these 12 years, the average compound return per year is: 12.17%

If you have deposited the maximum amount of TFSA every year starting in 2009, and invested in SPY, then as of November 16, your profit is $69,812.23 CAD. Remember, any amount you withdraw from your TFSA, you do not need to pay any taxes. For comparison purpose, let’s say you invested in a non-registered account instead of TFSA, and withdraws the full amount on November 16, this $69,812.23 CAD will become your capital gain, you must pay the corresponding tax. Investors pay Canadian capital gain tax on 50% of the capital gain amount. If your tax bracket is 37.16%, then you must pay: $69,812.23 x 50% x 37.16% = $12,971.11 CAD of tax In other words, putting money in TFSA would save you $12,071.11 CAD。

Below is a chart listing detailed calculation:

Your profit as of November 13 = Total Amount – Money You Deposited

= $139,312.23 – $69,500

= $69,812.23 CAD

Above calculation is done using SPY as investment product. In fact, it is entirely possible to achieve better returns than SPY. If you can achieve an average annual compound return of 18%, and maximize your TFSA room every year, you’re your profit as of November 13 is $129,762.09 CAD. Simply replace the 12.17% with 18% in the chart above to do the calculation, compound interest is very powerful. Once again, you do not need to pay tax on the profit you earn in TFSA, so using the tax bracket we used above, depositing in TFSA would save you $129,762.09 x 50% x 37.16% = $24,109.8 CAD comparing to depositing in non-registered account.

Who can open a TFSA?

Any individual who is 18 years of age or older and who has a valid social insurance number (SIN) is eligible to open a TFSA.

TFSA Contribution Room

Since 2009, your TFSA contribution room accumulates every year.

Any unused TFSA room will be automatically added to next year.

Your TFSA contribution room information can be found by using one of the following services:

-MyCRA

-Tax Information Phone Service (TIPS) at 1-800-267-6999

Withdrawals from a TFSA

Depending on the type of investment held in your TFSA, you can generally withdraw any amount from the TFSA at any time.